Trading Order Types | FBS

What a Trade order is

A Trade order consists of instructions to a broker to purchase or sell an asset on a trader’s behalf. Orders are usually placed via the phone or through a trading platform. Also, traders can place orders using automated trading systems and algorithms. When an order is placed, it follows a process of order execution.

Several order types allow traders to place restrictions affecting the price and execution time. These conditional instructions can include a particular price level (limit) for order execution and the time range to remain the order in force. They can also dictate whether an order is triggered or canceled based on another order.

Traders use different order types based on their style, experience, and trading strategy. Using each type greatly increases your chances of success in the financial markets. So in this article, we will explore each type of trading order in detail.

Market order

A market order is immediately buying or selling an asset at the best available price. It needs liquidity to be filled, meaning it is executed based on the limit orders already placed in the order book.

Setting a market order is your best option if you want to buy or sell instantly at the current market price. For example, the XAUUSD price might rise rapidly, and you want to buy it as soon as possible. In this case, you’d place a market order and buy XAUUSD within a millisecond.

How a market order works

Unlike limit orders placed on the order book, market orders are executed instantly at the current market price. A Trade always has two sides: the maker and the taker.

Placing a market order means taking the price set by someone else. For example, a broker matches a purchase market order to the lowest ask price in the order book, but, in contrast, it matches a sell market order with the order book’s highest bid price.

As mentioned, market orders require a broker to have liquidity in the order book to meet the instant demand. Placing a market order, a trader pays higher fees as a market taker since such orders remove liquidity from a broker.

A market order example

It’s much simpler to understand the relationship between a market maker and taker with the numbers, so let’s see an example.

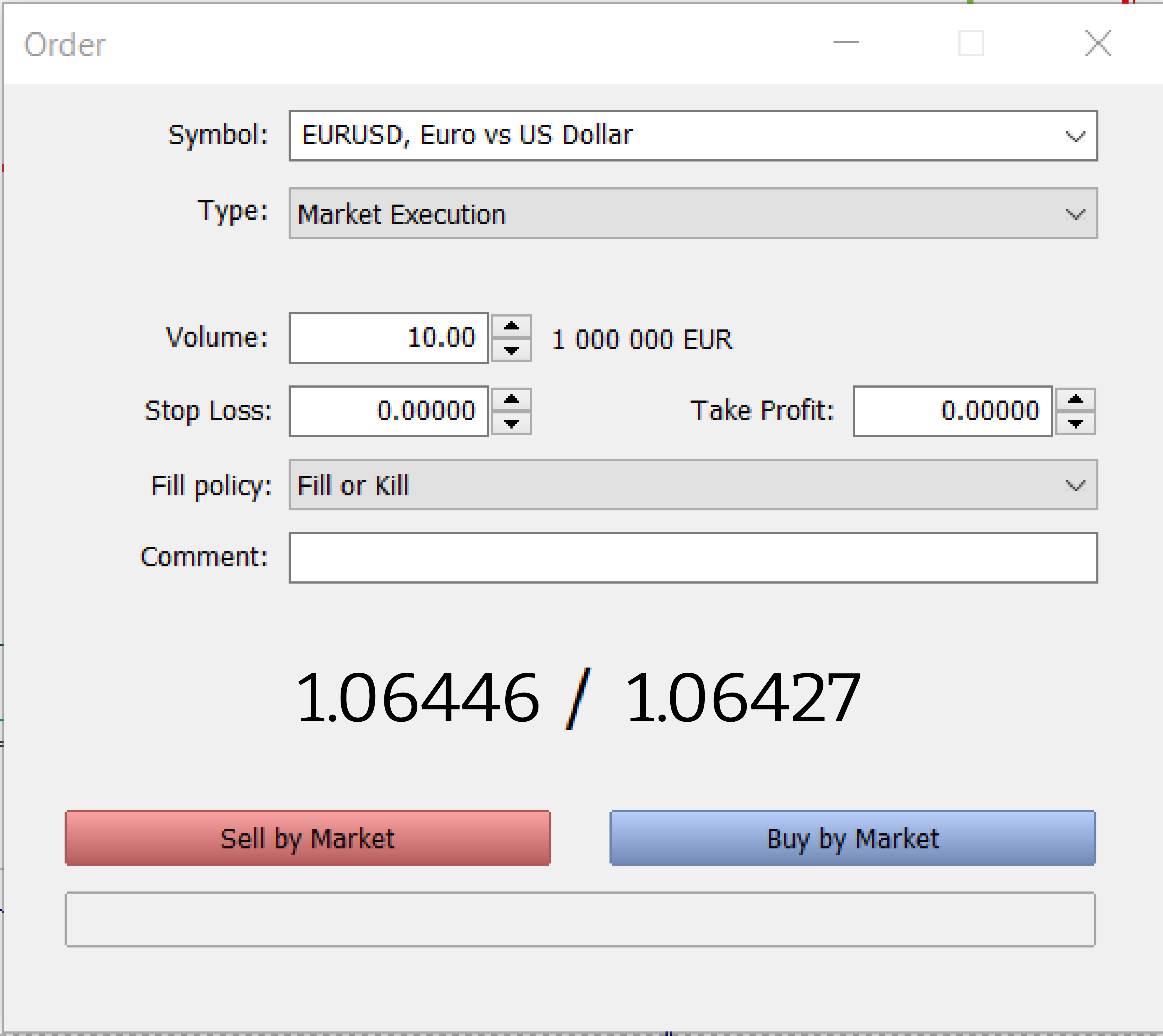

Imagine you want to buy one lot of EURUSD, and the current market price is around $1.0643. To create a buy market order, you enter “1” in the volume field and click “Buy by Market.”

New market order

After placing your order, the broker looks at the order book containing the limit orders with a specific quantity and price to buy or sell an asset. In this case, your market order to purchase one EURUSD lot at the market price will match the lowest sell limit order in the order book.

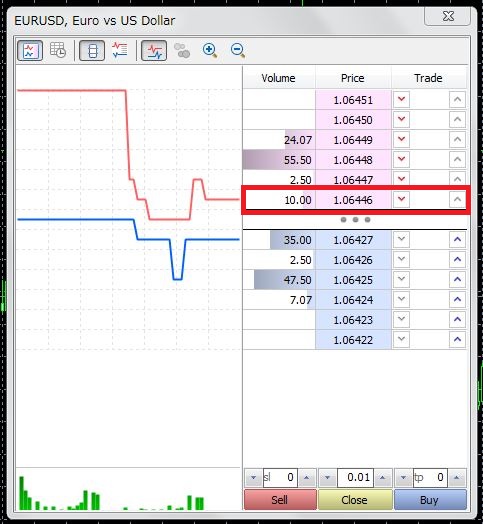

Depth of Market

As you can see, the lowest sell limit order in the book is 10 lots of EURUSD with a price of 1.06446. Your purchase market order will buy one EURUSD lot from the ten lots offered, giving you an entry price of 1.06446.

But let’s say you want to buy 100 lots of EURUSD at the current market price. The cheapest sell limit order available needs more volume to fill your entire market buy order. Your market order’s remaining volume will automatically match the next best-sell limit orders until it’s filled. As a result, you will buy 100 lots with an average price of all lots you’ve purchased. This process is called slippage, which is why you pay higher prices and fees (or receive a lower price) as a market taker.

Pending order

A pending order is an instruction to buy or sell an instrument with certain preconditions specified by a trader. When placing a pending order, traders inform a broker that they do not want to enter the market with the current market price but want to execute an order if the market price reaches a certain level.

Pending orders fall into three categories: limit orders, stop orders, and stop-limit orders.

Limit order

A limit order is a buying or selling of an asset with a restriction on the maximum price to be paid or the minimum price to be received (“limit price”).

A limit order may fit if you want to buy at a price lower than the current market price or sell at a price higher than this current price. If the order is filled, it will only be at the specified limit price or better. However, it is unnecessary to execute an order as the market price might never reach a trader’s limit order.

How a limit order works

A limit order is placed in the order book immediately after submitting it. However, it will be filled just if the asset price reaches the specified limit price or better.

For example, you want to sell an Apple stock at $100 while the current price is $90. You can place an Apple sell limit order of $100. When the price reaches the target price or above, your order will be executed depending on market liquidity. If other Apple sell orders are placed ahead of yours, the system will execute those orders first. Your limit order will be filled afterward with the remaining liquidity.

A limit order example

Limit order example

Limit order example

The above chart illustrates the use of market orders versus limit orders. In this example, the last Trade price was roughly $134.80.

A trader who wants to buy or sell an asset as quickly as possible would place a market order, which is mostly executed immediately at or near the stock’s current price of $134.80 (blue line).

A trader who wants to buy the stock dropping to $124.50 would place a buy-limit order with a limit price of $124.50 (green line). If the stock falls to $124.50 or lower, the limit order will be triggered and executed at $124.50 or below. If the stock cannot fall to $124.50 or below, no execution will occur.

A trader who wants to sell the stock rising to $138 would place a sell limit order with a limit price of $138 (red line). If the stock reaches $138 or higher, the limit order will be triggered and executed at $138 or above. If the stock cannot rise to $138 or above, no execution will occur.

Note that even if the stock reaches the specified limit price, your order may not be filled cause of orders ahead of yours, eliminating the availability of shares at the limit price. Pay also attention that with a limit order, the order execution price can be lower than the limit price when buying or higher than the limit price when selling.

Important to remember that if the limit order to buy at $124.50 was set as “Good ’til Canceled” rather than “Day Only,” it would still be in effect the following trading day. If the stock opens at $120, the buy limit order would be triggered, and the purchase price is expected to be around $120, a more favorable price for the buyer. Conversely, with the sell limit order at $138: if the stock opens at $145, the limit order will be triggered and filled at a price close to $145, again, more favorable to the seller.

Stop order

A stop order is an order to buy or sell an asset at the market price once it reaches a specified price (“stop price”).

How a stop order works

If an asset reaches the stop price, the order becomes a market order and is filled at the next available prices according to the depth of the market. If an asset fails to reach the stop price, the order won’t be executed.

A stop order may fit in the following scenarios:

- The price follows the expectations after opening a position, and a trader wants to protect profits in a reversal case.

- A trader wants to enter a position with the market order as soon as the price breaks below/above a certain level, believing it will continue to fall/rise.

- The price doesn’t follow the expectations, and a trader wants to limit potential losses (using Stop Loss, etc.)

A trader sets a sell stop order below the current market price. An order triggers when the market price drops at or below a stop price. Once it happens, the stop order will be triggered and become a market order, selling the asset at the market’s current price.

A stop order may also fit to buy. A trader sets a buy stop order above the current market price. An order triggers when the market price rises at or above a stop price. Once it happens, the stop order turns into a market order, buying the asset at the market’s current price.

A stop order example

Traders mostly use stop orders to limit potential losses and reduce risk exposure (Stop Loss, etc.) With a stop loss order, a trading position will close if the price goes in the opposite direction. Using a Stop Loss order, a trader limits the risks, setting a limited amount affordable to lose in cases the market moves against expectations.

For example, a trader who buys Apple stock at $134.50 per share might set a stop loss order to sell shares at $124.50 if the price goes against expectations. It effectively limits investment risks to a maximum loss of $10 per share. If the stock price falls to $124.50 per share, the order will automatically be executed, closing the Trade.

Stop Loss orders can be beneficial during essential events and substantial price movement against a trader’s position.

Stop order example

It’s vital to realize that stop orders differ from limit orders that are only executed if an asset can be bought (or sold) at a specified price or better.

In a rapidly changing market, a stop order may not be filled at the exactly specified stop price level but is usually filled fairly close to it. But stop loss orders cannot provide much protection in some extreme situations.

For example, a trader has purchased a stock at $130 per share and placed a sell stop order at $125 a share, and the stock market closes. Then, catastrophic news about the company comes out after the trading day closes.

If the stock price gaps lower on the market’s opening the next trading day at $120, then the trader’s $125 a share sell stop order will immediately be triggered because the price has fallen below the order price. But it will not be filled anywhere close to $125 a share. Instead, it will be filled around the prevailing market price of $120 per share.

With limit orders, your order is guaranteed to be filled at the specified order price or better. The stop order guarantees that when triggered, it will be immediately executed and filled at the prevailing market price.

Stop-limit order

A stop-limit order combines a stop trigger and a limit order. The stop order adds a trigger price for the broker to place your limit order. Below you can learn how it works.

How stop-limit order works

The best way to understand a stop-limit order is to break it into parts. The stop price acts as a trigger to place a limit order. When the market reaches the stop price, a broker automatically creates a limit order with a custom price (limit price).

Although the stop and limit prices can be the same, this isn’t a requirement. It would be safer to set the stop price (trigger price) a bit higher than the limit price for sell orders. You can set the stop price for buy orders a bit lower than the limit price. This increases the chances of your limit order filling after it triggers.

Examples of buy and sell stop-limit orders

Buy stop-limit

Imagine that XAUUSD is currently at $1914, and you would like to buy it when it moves up. However, you only want to pay a little for the XAUUSD if it quickly begins to rise, so you need to limit the price you will pay.

Buy Stop-Limit order example

Suppose your technical analysis shows an uptrend might start if the market breaks above $1928. However, you prefer to avoid trading a fake breakout and use a buy stop-limit order to open a position in the breakout case. You set your stop price at $1928 and your limit price at $1935. As soon as XAUUSD reaches $1928, a limit order to buy XAUUSD at $1935 will be placed. Your order might be filled for $1935 or lower. Considering your limit price is $1935, your order might only be partially filled if the market goes up too quickly above it.

Sell stop-limit

Imagine that you bought XAUUSD at $1860, and it is now at $1913. To prevent losses, you use a stop-limit order to sell XAUUSD if the price drops back to your entry.

You set up a sell stop-limit order with a stop price of $1870 and a limit price of $1860 (the price you purchased XAUUSD at). If the price reaches $1870, a limit order to sell XAUUSD at $1860 will be placed. If the price reaches $1860, your order might be filled with a price of $1860 or higher.

Sell Stop-Limit order example

Trailing stop order

A standard stop order modification that can be set at a defined percentage or points amount away from a current market price is called a trailing stop. For a long position, an investor places a trailing stop loss below the current market price. For a short position, an investor places the trailing stop above the current market price.

A trailing stop is designed to protect gains by remaining a Trade open as long as the price moves in the trader’s favor. The order closes the Trade if the price changes direction by a specified percentage or points amount.

A trailing stop is usually placed at the same time the initial Trade is placed, although it may also be placed after the Trade.

How a trailing stop order works

Trailing stops only move in one direction because they are designed to lock in profit or limit losses. If a 10% trailing stop loss is added to a long position, a sell Trade will be issued when the price drops 10% from its post-buy peak price. The trailing stop only moves up once a new peak has been established. Once the trailing stop moves up, it cannot back down.

A trailing stop is more flexible than a fixed stop loss order, as it automatically tracks the stock’s price direction and does not have to be manually reset like the fixed stop loss.

Investors can use trailing stops in any asset class, assuming the broker provides that order type for the traded market. Trailing stops can be set as limit orders or market orders.

The key to using a trailing stop efficiently is to set it at a level that is neither too tight nor too wide. Placing a too-tight trailing stop loss could give the Trade no space to move in the trader’s direction cause the trailing stop is triggered by normal daily market movement. Regular market movements will not trigger a trailing stop that is too large, but it does mean the trader is taking on the risk of unnecessarily large losses or giving up more profit than they need to.

While trailing stops lock in profit and limit losses, establishing the ideal trailing stop distance is difficult. There is no perfect distance because the moves of markets and financial assets always change. Despite this, trailing stops are an effective tool.

Important: The ideal trailing stop loss will change over time. During more volatile periods, a wider trailing stop is a better bet. A tighter trailing stop loss may be effective during quieter times or in a very stable stock.

Trailing stop order example

Assume you bought XAUUSD at $2 000. Looking at prior advances, you can see the price often experiences a pullback of 2% to 4% before moving higher again. These prior movements can help set the percentage level for a trailing stop.

Choosing a 1% or even 3% trailing stop may be too tight. Even minor pullbacks tend to move more than this, so the trailing stop will likely stop the Trade before the price can increase.

Choosing a 10% trailing stop is excessive. Based on recent trends, the average pullback is about 3%, with a maximum near 4%.

A better trailing stop loss would be 5% to 6%. This gives the price room to move but also gets the trader out quickly if the price drops by more than 6%. A 5% to 6% drop is larger than a typical pullback, meaning this could be a trend reversal instead of a pullback.

Using a 5% trailing stop, your broker will execute a sell order if the price drops 5% below your purchase price – $1900. If the price never moves above $2 000 after you buy, your stop loss will stay at $1900. If the price reaches $2100, your stop loss will move up to $1995, which is 5% below $2100. If the price starts falling from $2100 and does not go back up, your trailing stop order stays at $1995, and if the price drops to that, the broker will sell an asset.

How to choose the right Trade order

Market orders are the logical place to start when you first start trading and investing because they are simple and available with all brokers. You will definitely get your Trade executed. Quickly, though, you will realize that market orders alone are insufficient.

The key is to match your order type to your trading strategy and use the best order type for the situation. All traders and investors should know the market, limit, stop, stop-limit, and trailing stop. This will help improve your trading strategy or create a new one and reduce the need to watch the market moment constantly.

Usually, professional traders use order types in the following way:

- Limit orders – to gain position ahead of the price reversal or take profit;

- Stop orders – limit losses by setting stop loss orders;

- Stop-limit – to follow the trend after a breakout;

- Trailing stop – to protect gains.

Conclusion

Check the range of order types each broker supports and what fees they charge for complex order types, selecting a broker. This is a key differentiator between brokers that really affects your trading in the long run.

With FBS, you’re welcome to use any order type without any additional fees. Feel free to create an account and try our high-quality trading services and conditions.

,

2023-06-27

• Updated

Other articles in this section

- Economic Calendar: How to Read and Use

- How to open and close a Trade in MetaTrader?

- How Much Do You Need to Start Trading Forex

- Forex Demo Account

- How to determine position size?

- Leverage and Margin: How Can You Use Them in Forex Trading?

- What Are Rollover and Swap and How to Use Them When Trading?

- When is the Forex Market Open?

- What Are Bid, Ask, and Spread?

- Calculating profits

- What are Lots, Points, and Leverage

- How to Trade?

- Currency Pairs in Forex Trading

- What Software Do You Need for Trading?

- The Advantages and Risks of Trading Forex

- What is Forex Trading?

Unleash the power of strategic Trading.

Unleash the power of strategic Trading.