Calculating profit of your Forex trades

If you entered EUR/USD long at 1.0500 and prices moved higher to 1.0550, it means that you made 50 pips. Congratulations! You’ve earned some money. OK, you might say, but how much? Good question! Let us calculate your profits.

There is a simple formula for this:

1 pip in the decimal form / the current exchange rate of the quote currency to the US Dollar = value per pip.

In our case:

0.0001/ 1 = 0.0001 (rounded up). It means that you will get this sum for every pip of your profitable Trade.

As you can see is not a large sum of money. Well, it’s because it is the value of a pip per unit, but traders operate with a bigger number of units — so-called lots.

Calculate the profit using the FBS calculator

What is a lot?

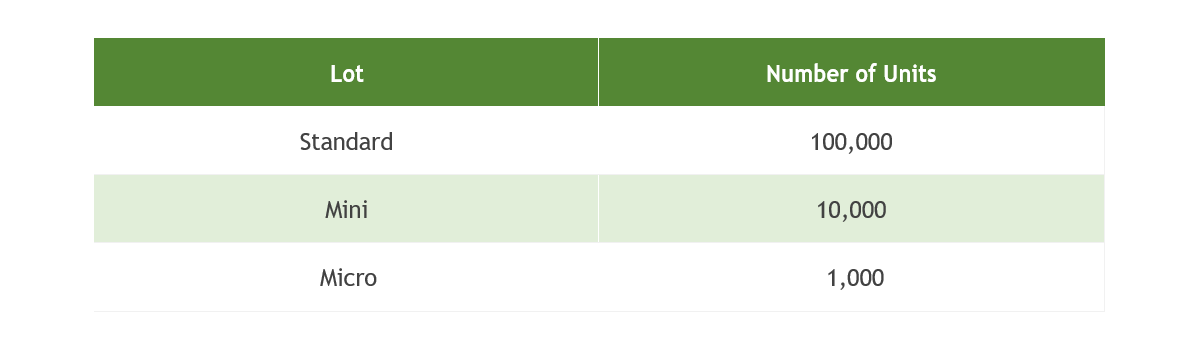

A lot is an order of a certain number of units. Historically, spot Forex trading was only available in specific amounts of base currency called lots. A standard size of a lot equals to 100,000 units of a base currency. Later on, when Forex market opened for traders with smaller capital, a mini and even a micro lot became available.

Calculating 1 pip value for different currency pairs

You may see that the smallest lot is a micro lot (1,000 units of a base currency, it is often referred to as 1K). You can Trade 1 000, 2 000, 3 000 or 124 000 units so long as it can be multiplied by 1K. Each 1K is referred to as a lot.

So, if you as in the last example open a long Trade with one standard lot on EUR/USD, you will be buying 100,000 units. In this case, your profit will be not 0.00009478 USD for 1 pip the price goes in your favor, but 0.00009478 USD *(multiplied) 100,000 which is approximately 9.4787 USD. You may also open Trade with mini (10,000), or even micro (1,000) lots. In this case, your profits will be something like 0.94786 USD and 0.09478 USD per 1 pip accordingly.

You should remember that the US Dollar is a quote currency in many pairs (EUR/USD, GBP/USD etc.). It means that the exchange rate of the quote currency to USD equals to 1.

- For such pairs one pip will always cost $10 when we Trade a

100 000 — unit contract (1 standard lot):100 000 * 0.0001 / 1 = $10 (pip value for EUR/USD)

- For the pairs where the US Dollar is a base currency (USD/CHF, USD/CAD), pip value depends on the exchange rate:

100 000 * 0.0001 / 1.0195 = $9.8 (pip value for USD/CHF)

- For the pairs that include the Japanese yen the pip value is calculated as follows:

100 000 * 0.01 / 120.65 = $8,28 (pip value for USD/JPY)

,

2023-05-25

• Updated

Other articles in this section

- Economic Calendar: How to Read and Use

- How to open and close a Trade in MetaTrader?

- How Much Do You Need to Start Trading Forex

- Forex Demo Account

- How to determine position size?

- Leverage and Margin: How Can You Use Them in Forex Trading?

- What Are Rollover and Swap and How to Use Them When Trading?

- Types of Trading Orders: Market, Limit, Stop, Trailing Stop, Stop-Limit

- When is the Forex Market Open?

- What Are Bid, Ask, and Spread?

- What are Lots, Points, and Leverage

- How to Trade?

- Currency Pairs in Forex Trading

- What Software Do You Need for Trading?

- The Advantages and Risks of Trading Forex

- What is Forex Trading?

Unleash the power of strategic Trading.

Unleash the power of strategic Trading.