What are Rollover and Swap in Forex | FBS

Depending on their trading style, Forex day traders may face additional profits or expenses when holding positions open overnight.

If you are only planning on opening and closing your trades within one day, you won’t need to worry about that, but it is still worth learning about should you change your strategy or experiment with extended orders.

When you open and close a position within one day, you do not have to pay additional interest. However, if you choose to hold the position open overnight, you must consider the Forex rollover.

What is a rollover in Forex trading?

Rollover is when the position is held open overnight. When that happens, the interest rates of the currencies in the FX pair are counted against each other. Depending on the interest rates, the trader is credited or charged a particular sum.

What is a swap in trading?

The sum the trader can gain or lose due to rollover is called a swap. A rollover may result in benefits or charges depending on the interest rate differentials. The country’s central bank sets the interest rate of each currency. Usually, the interest rates are influenced by major economic events in the country, which you can monitor in the economic calendar.

Rollover calculation

To calculate rollover benefits or charges, you can use the swap rate formula, which looks different for long and short trades.

Swap Short calculation

Short Trade (or bearish Trade) is when you sell the currency pair with the expectation to profit from its loss in value.

Let’s say that the EURUSD is trading at 1.1000, the USD federal funds rate is 3%, and the European Central Bank’s interest rate is 3.5%. If you open a short position (sell) on the EURUSD for 1 lot, you essentially sell €100 000, borrowing it at an interest rate of 3.5%. By selling EURUSD, you’re buying USD, which earns a 3% interest rate. The interest rate differential is 0.5.

Now, let’s say your broker charges a 0.25% markup for the swap. Since the interest rate of the currency you are selling (EUR) is higher than that of the currency you’re buying (USD), you add the markup to the formula.

For this example, we use a 365-day year, but some brokers use 360 days. Depending on their Trade instrument, others will use 365 days and 360 days.

In that case, the formula is:

- Swap rate = (Contract x [Interest rate differential + Broker’s mark-up] /100) x (Price/Number of days per year);

- Swap Short = (100 000 x [0.5 + 0.25] /100) x (1.1000/365);

- Swap Short = USD 2.26 or 2.26 points.

In this case, you are selling the EUR, and its interest rate is higher than the USD one; therefore, the 2.26 USD is deducted from your account when your EURUSD position rolls over to the next day.

Swap long calculation

Long Trade (or bullish Trade) is when you purchase with the expectation that the currency you bought will increase in value and you will profit from this.

By going long on the EURUSD, you’re buying EUR and selling USD. That means you would essentially be buying €100 000, which earns an interest of 3.5% using a 3% interest rate USD. If the broker charges a 0.25% markup, you will subtract it from the formula since the interest rate of the currency you are selling is lower than that of your buying currency.

In that case, the formula is:

- Swap rate = (Contract x [Interest rate differential – Broker’s mark-up] /100) x (Price/Number of days per year);

- Swap Long = (100 000 x [0.5 – 0.25] /100) x (1.1000/365);

- Swap Long = USD 0.75 or 0.75 points.

Here, you are buying the EUR, and its interest rate is higher than the USD’s. Therefore, the 0.75 USD is credited to your account when your EURUSD position rolls over to the next day.

Note: If the difference between the interest rates is equal to or smaller than the broker’s markup, you will still be charged for the buy position.

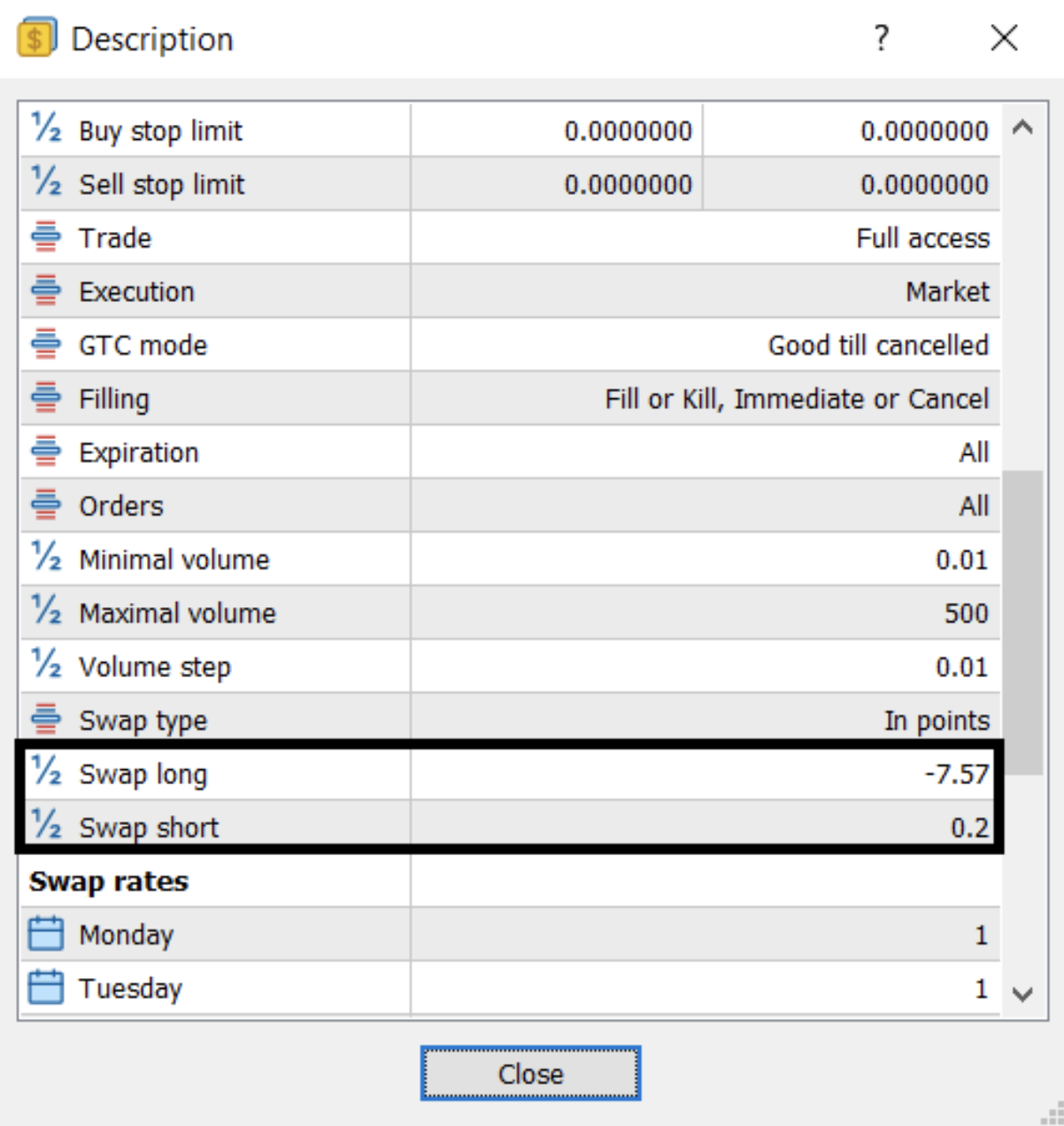

Thankfully, you don’t need to manually calculate the swap every time you engage in swap trading, as there are special tools. You can open the Contract specifications page to monitor the Forex Swap rates table: our table includes swap long and swap short rates.

Let’s look at an example: take the AUDCAD Forex pair.

Swap long (in this case, -7.57) is the interest rate applied to your Trade if you buy AUDCAD and keep the position open overnight (meaning that you will lose 7.57 points on your order). At the same time, the swap short (0.2) is the interest rate that will be applied to your sell order if you hold it overnight (meaning that you will gain 0.2 points on your order). The figures are shown as points, which measure the smallest price movement, so they do not represent any specific currency. They change depending on the Forex pair volatility, so you must closely monitor the financial events calendar and Forex news.

You can also see your trading platform’s current swap long and swap short figures for a specific pair. For example, in MetaTrader 4 (or MetaTrader 5), click the right mouse button on the currency pair and choose Specification. You might need to scroll down in the window that opens.

3-day swap

The rollover typically happens at 5 p.m. Eastern Standard Time (GMT-5) every weekday at the end of the New York session. However, there is one special day for rollover – Wednesday.

Suppose you keep the position open overnight after the Wednesday session is finished. In that case, the swap will be multiplied by three to account for rolling over the weekend when the Forex market is not working.

The triple swap, or 3-day swap, happens on Wednesday because most instruments need two business days to be settled (for all the financial transactions to be completed). So, if you open a position on Wednesday, it will be settled on Friday. If you roll the Wednesday position over to Thursday, the swap rate will also account for rolling the position over the weekend, tripling the triple rate.

Swap-free options

Forex trading is welcoming to people of all beliefs. Some brokers recognize that the Islamic faith prohibits its followers from receiving or paying interest and creates unique conditions for them. For example, FBS has a swap-free option for Muslim clients who also want to enjoy trading and hold positions open overnight but cannot pay or receive swap interests on their positions.

,

2024-01-10

• Updated

Other articles in this section

- Economic Calendar: How to Read and Use

- How to open and close a Trade in MetaTrader?

- How Much Do You Need to Start Trading Forex

- Forex Demo Account

- How to determine position size?

- Leverage and Margin: How Can You Use Them in Forex Trading?

- Types of Trading Orders: Market, Limit, Stop, Trailing Stop, Stop-Limit

- When is the Forex Market Open?

- What Are Bid, Ask, and Spread?

- Calculating profits

- What are Lots, Points, and Leverage

- How to Trade?

- Currency Pairs in Forex Trading

- What Software Do You Need for Trading?

- The Advantages and Risks of Trading Forex

- What is Forex Trading?

Unleash the power of strategic Trading.

Unleash the power of strategic Trading.