Advantages and disadvantages of trading on the Forex market 2022 | FBS

Like most trading activities, Forex trading has both pros and cons. Traders seeking to enter the Forex market should weigh its advantages and disadvantages to decide if the market is attractive and suitable for them. Let’s discuss all sides of Forex trading.

What is Forex trading?

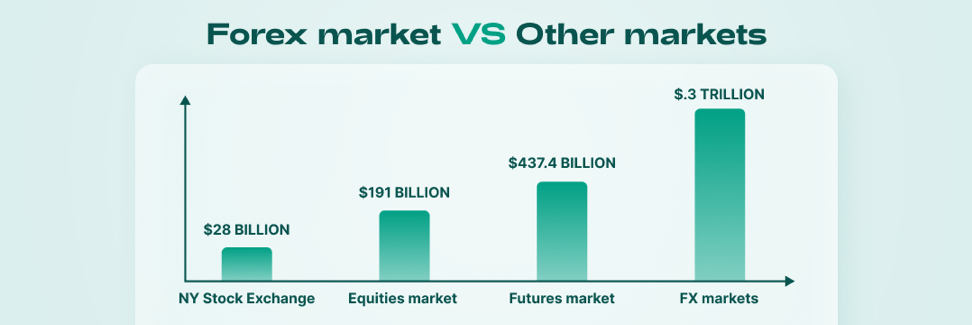

The foreign exchange market, also known as Forex or FX, is a global market for exchanging national currencies. It has become the largest financial market in the world due to its accessibility, liquidity, and international character, among many other factors. Unlike other markets, you can buy and sell currencies through intermediaries to make a profit without any physical exchange.

Advantages of Forex market

There are numerous advantages of Forex appreciated by traders from all over the world. Let’s see the most common reasons to dive into the world of trading.

Accessibility

Accessibility of the foreign exchange markets is constantly expanding, and more people get the chance to try themselves in Forex trading. While big financial institutions represent a big part of Forex traders, online access to the market makes Forex trading profitable for individual traders as well. Moreover, the increased use of trading apps and online brokers makes Forex trading more accessible to people who want long-term and short-term profits. You can open a Forex trading account in a few simple steps.

Market is large and global

Forex is the largest financial market in the world, and in the near future, it won’t give up this title. On average, $4 trillion to $5 trillion is traded daily. That’s about $200 billion an hour, $3 billion a minute, and $50 million a second. Moreover, the Forex market has a huge trading volume. There are so many transactions in Forex, like nowhere else. It’s because Forex provides unrivaled liquidity to traders, who can enter and quit the market in seconds at any time.

Thanks to millions of traders from all over the world, Forex is truly the largest financial market. Thus, the market can be used to access overall global Trade and economic activity.

Flexibility

Flexibility in the Forex market means that there are no restrictions on the amount of money that can be used in trading. There’s also virtually no market regulation. This, combined with the fact that the market operates 24/5, creates a very flexible scenario for traders, especially those with permanent jobs. That’s why part-time traders prefer Forex, as it provides a flexible schedule with the least interference in their full-time work.

Transparency

The Forex market is huge and operates across multiple time zones. No country or central bank can control it or manipulate prices for an extended period of time. This makes trading conditions fair and allows individual market players to achieve efficient results. Although information about the Forex market is highly available, some entities may gain short-term benefits due to the time difference or little delay in the information transmission. However, this advantage can’t be maintained over time. Thus, Forex is a truly transparent market where everyone has a chance to profit.

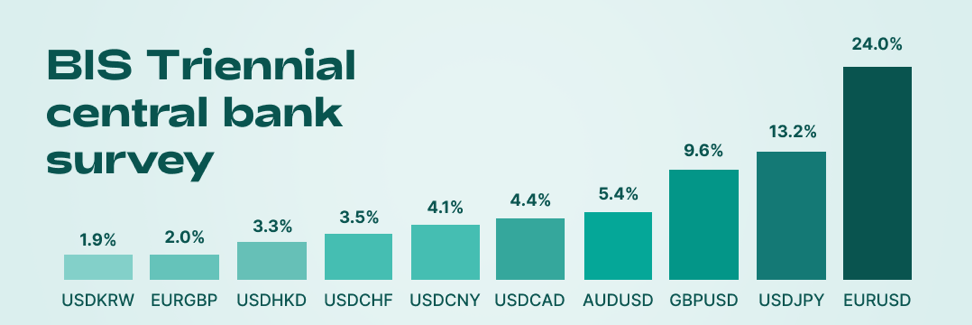

Trading options

Forex provides traders with a wide range of trading options. Traders can Trade hundreds of currency pairs. Traders’ favorite pair is EURUSD. Moreover, FBS offers the opportunity of Contract For Difference (CFD) trading, which allows trading commodities, cryptocurrencies, metals, stocks, and indices. Due to that, traders can choose a suitable account type. Thus, the Forex market offers an option for any budget and for traders with a different risk appetite.

Transaction costs

Forex creates a favorable environment with transaction costs that are lower than in other markets. The reason is that the Forex market is mainly run by brokers who provide a two-way quote. They reserve the spread for themselves to cover the risks. The spread is measured in points, which is the difference between the sell price and the buy price. FBS doesn’t usually charge any additional commissions, as it takes only the spread, which is really low. However, some account types have their specifics. For example, an ECN account, in addition to a small spread, also takes a commission of $6. Besides, you also pay a commission for trading stocks and crypto.

Leverage

A small deposit can go a long way. With leverage, you can “borrow money” from your broker to Trade on top of your actual deposited funds. It’s a powerful tool and one of the most attractive features of Forex trading. FBS offers leverage up to 1:3000, which gives you increased buying power and can bring big gains, but it also carries the risk of losses. Please ensure you fully understand the risks of trading with leverage before using it. You should Trade only the money you can afford to lose.

Forex’s suitability for beginner traders

Beginner traders who want to make small trades can easily enter the Forex market. One of the many advantages of Forex is that brokers offer cent accounts.

A cent account is a real trading account, but the initial deposit starts with $1. Using it, beginner traders can apply their skills in practice before making big trades. This is the ideal way to get familiar with trading tools and methodologies, such as fundamental and technical analysis, without serious financial commitment. However, this doesn’t change the fact that skills and knowledge are critical to successful trading.

Profit from going “long” or “short”

In other markets, CFDs are often used to open both long and short positions on an instrument. In the Forex world, where currencies are traded in pairs, you are always buying one currency and selling another. For example, a currency pair is always displayed with the base currency as the first place and the quote currency as the second place. This means that the price of the AUDUSD pair shows how much one unit of AUD is worth in US dollars. If we think the Australian dollar will rise against the US dollar, we will open a buy Trade in this pair (going long). If we think the opposite will happen and the Australian dollar weakens against the US dollar, then we will sell the pair (going short).

Disadvantages of Forex Market

Counterparty risks

The Forex market is an international market. Thus, the regulation of the Forex market locally is a complex issue as it concerns the sovereign currency of a country. Therefore, the Forex market is less regulated than other financial markets. There’s no single global regulator. There’re only separate governmental and independent institutions in particular regions that supervise Forex trading. In turn, traders need to make an effort to pick a reliable broker. For that, it’s necessary to check the company’s age, licenses, and reputation.

Leverage risks

Forex market provides maximum leverage that automatically implies risk. There’s no limit to the number of movements that can occur in the Forex market on a given day. That’s why it’s possible that a person could lose an entire deposit in a matter of minutes using high leverage. Beginner traders are more likely to make these mistakes because they don’t understand the risk that leverage brings.

Operational risks

It’s difficult to keep track of time in Forex trading. The Forex market is open most of the time, and people can’t monitor their open trades constantly. Therefore, traders use algorithms to protect the value of their trades when they are away from the price charts. Alternatively, international firms have sales departments scattered around the globe. If a person doesn’t have knowledge of how to manage positions, Forex trading can result in a significant loss.

Volatility

All markets sometimes experience volatility, and the Forex market isn’t different. Traders hoping for short-term profits may face unexpected extreme volatility that can make their trading strategies unprofitable.

Fewer residual returns

Forex trading is usually focused primarily on capital gains from the appreciation or depreciation of one of the two currencies in a currency pair. On the other hand, Forex positions held overnight can generate income or earn interest. It depends on the difference in interest rates applied in the countries issuing the bought and sold currency. This is often referred to as “rollover” or “carrying” interest. However, the situation can be the opposite. The broker can charge you for leaving the Trade open overnight, so pay attention to that. As a result, traders have to understand swaps if they want to keep the Trade open outside of a single day.

Why start trading Forex now?

For anyone interested in starting a career as a Forex trader, it’s essential to evaluate the advantages and disadvantages listed above carefully. If the cons of Forex outweigh the pros for you, then it may be better to look for a more suitable way of earning money.

However, everyone has a chance to build a career in the foreign exchange market. The freedom to Trade autonomously and remotely in the Forex market is life-changing for those who are up to the challenge. With sufficient risk capital and reliable brokerage services in the Forex market, you can make good money trading major, minor, or exotic currency pairs.

Conclusion

So, is Forex trading a good career? The answer depends on resources, abilities, and interests. If you have the three D’s of desire, discipline, and dedication, then yes, Forex trading can be a lucrative and enjoyable way to make a living.

,

2023-06-26

• Updated

Other articles in this section

- Economic Calendar: How to Read and Use

- How to open and close a Trade in MetaTrader?

- How Much Do You Need to Start Trading Forex

- Forex Demo Account

- How to determine position size?

- Leverage and Margin: How Can You Use Them in Forex Trading?

- What Are Rollover and Swap and How to Use Them When Trading?

- Types of Trading Orders: Market, Limit, Stop, Trailing Stop, Stop-Limit

- When is the Forex Market Open?

- What Are Bid, Ask, and Spread?

- Calculating profits

- What are Lots, Points, and Leverage

- How to Trade?

- Currency Pairs in Forex Trading

- What Software Do You Need for Trading?

- What is Forex Trading?

Unleash the power of strategic Trading.

Unleash the power of strategic Trading.